Note: Ideally, the historical data of the portfolio value should be longer, but the exercise here is intended for illustrative purposes. The historical portfolio value data – wherein the value of the portfolio value is based on the end of each month – is as follows. Suppose a hedge fund is measuring its maximum drawdown from the start of 2006 to the end of 2008. The maximum drawdown formula is as follows. If calculating the maximum drawdown in Excel, ensure the formula is dynamic to capture each new peak and restart of the cycle, i.e. Multiply by 100 to Convert into Percentage.Divide Difference (Trough – Peak) by Peak Value.Subtract Trough Value by Peak Value of Portfolio.The steps to compute the maximum drawdown of a portfolio are as follows. The inputs to the MDD formula are thus the lowest and highest points in the value of a portfolio to calculate the most significant percent drop off in the portfolio’s value. The maximum drawdown of a portfolio is predicated on two data points:

Visual of maximum drawdown stocks how to#

Learn More → Hedge Fund Quick Primer How to Calculate Maximum Drawdown?

Visual of maximum drawdown stocks full#

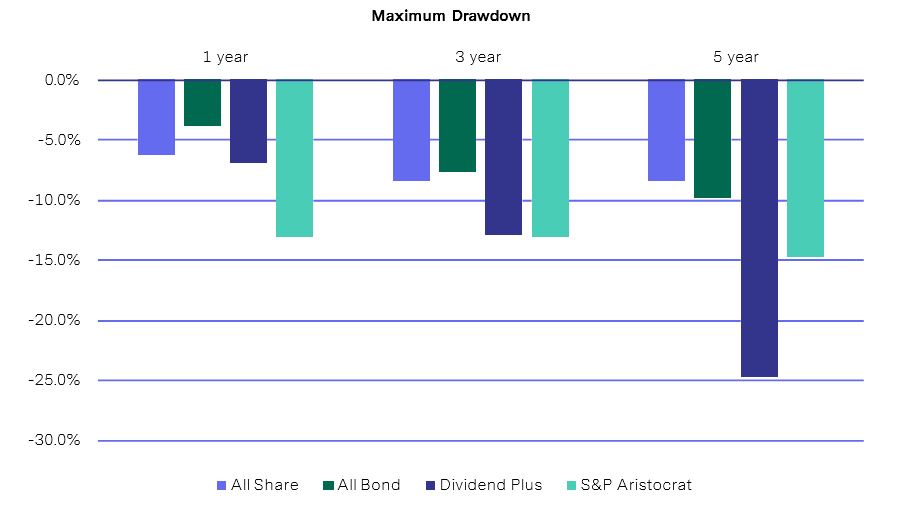

Why? The portfolio has most likely undergone at a bare minimum, one full economic cycle, including one major recessionary period, i.e. However, the MDD of the portfolio being analyzed is more meaningful for portfolio’s with long standing performance data. The question answered by the maximum drawdown from a backward-looking perspective is, “What is the maximum percent decline in the value of a given portfolio from the peak value to date?”īased on the historical drawdown to date, the firm can adjust their investment strategy to reduce the downside risk potential of its portfolio going forward. Investment firms, such as hedge funds and mutual funds, monitor the maximum drawdown of their portfolio as a method of quantifying the downside risk and have a historical precedence to reference. The maximum drawdown, or “MDD”, is a metric used to track the most significant percent decline in the value of a portfolio over a given period.Ĭonceptually, the maximum drawdown identifies the peak value and trough value of a portfolio, or single investment, i.e. I have often thought one more term for bear markets greater than -40 would be good, such as Super Bear, but I have other battles to fight.

What is the Definition of Maximum Drawdown? Chart A While the terminology for drawdowns is subjective, I'll stick with the ones that Sam Stovall (Standard and Poors) uses, as they are as good as any. I think that everyone has got a level of loss unable to accept, well, 15 is my maximum. The Maximum Drawdown (MDD) quantifies the maximum downside risk of an investment portfolio across a given time period. 2) Maximum Drawdown cannot be higher than 15.

0 kommentar(er)

0 kommentar(er)